Understanding the U.S. tax system can be intimidating, particularly considering all the kinds available, each with a different function. Regardless of your tax experience or first-time return filing, knowledge of the most often used tax forms is vital.

The Internal Revenue Service (IRS) records your income, claims deductions, and computes taxes using many forms. Together with their explanations, who should submit them, and what information they want, we will summarize the most regularly used U.S. tax forms in this blog.

Essential Tax Forms: An Overview

The IRS gathers data from taxpayers using a range of tax forms, each of which has a particular utility. These are some of the most often used tax forms, together with their intended use:

Form W-2: Tax Statement for Wage

Reports an employee’s Social Security benefits, income, and taxes deducted. Employers have to provide every employee a W-2 form by January 31st of every year.

Information needed:

- Name of employee, residence, Social Security number.

- Name, address, and Employer Identification Number (EIN) of your company.

- Pay, tips, and other compensation.

- Federal income tax deduction.

- Social Security tax deduction from your account.

- Medicare tax deduction from your accounts.

Form W-4: Employee’s Withholding Certificate

Employees complete Form W-4 to let their employer know how much federal income tax to withhold from their paychecks. The amount withheld is based on the employee’s filing status, number of dependents, and other personal financial details.

Accurately completing the W-4 ensures that the correct amount of tax is taken out, preventing underpayment or overpayment of taxes.

Who fills it out? Employees, when they start a new job or need to update their withholding information.

Purpose: To determine the correct federal tax withholding amount from an employee’s paycheck.

How to fill it out: Employees provide their filing status (single, married, head of household).

They indicate the number of dependents they can claim.

Optional: Employees can specify additional amounts they wish to have withheld or make adjustments for other income or deductions.

When to update: Major life events such as marriage, divorce, the birth of a child, or a significant change in income are reasons to update the W-4 to ensure proper withholding.

By adjusting the W-4, employees can help avoid owing taxes or receiving an unexpectedly large refund at tax time. Employers use the information provided on the W-4 to calculate the withholding amount from each paycheck.

Form 941: Employer’s Quarterly Federal Tax Return

Employers use Form 941 to record Medicare tax, Social Security tax, and federal income tax deducted from employee earnings. Every quarter, companies must submit this form reporting the taxes they have gathered from employee paychecks as well as the part owed for Social Security and Medicare.

Who files it?: Companies and organizations, among others, have staff.

The frequency of filing is quarterly. It has to be turned in on the last day of the month after each quarter ends.

Q1: Due by April 30

Q2: Due by July 31

Q3: Due by October 31

Q4: By January 31

Aim: Report the employer’s payroll tax portion as well as the amounts deducted from staff members for Medicare, Social Security, and federal income tax.

Fines: Fines include late submission or neglect to file, which could result in penalties and interest charges. Filing on time helps prevent further expenses.

Form 941 also incorporates tips, sick pay adjustments, and other unique salary issues. Employers must maintain proper payroll records if they want Form 941 filed appropriately.

Form 1099-MISC: Miscellaneous Income

Miscellaneous income, including rent, consulting fees, and freelance work is reported using Form 1099-MISC. Payers must send a copy to the recipient by January 31st of every year, together with a 1099-MISC form filed with the IRS.

Information needed:

- Payer’s name and address.

- Taxpayer identification number, recipient’s name, address, and taxpayer identity number.

- Amount of miscellaneous income paid.

- Type of income (e.g., freelance work, consulting fees, rent)

Form 1040: Individual Income Tax Return

Reportedly utilized the most tax form in the United States, Form 1040 reports personal income, deductions, and credits. People have to turn in a 1040 by April 15th every year. The form consists of numerous parts, among which:

- Earnings: This part lists earnings, salaries, tips, and self-employment revenue, among other sources.

- Deductions: Standard deductions, itemized deductions, and exemptions are all reported in this part together under deductions.

- Credits: All tax credits—including the Earned Income Tax Credit (EITC) and Child Tax.

The Form 1040 is accessible in multiple variations, such as:

- Form 1040A: For people with low incomes and few deductions, this form is a condensed version of Form 1040.

- Form 1040EZ: For people without dependents and with low incomes, this is a condensed form of Form 1040.

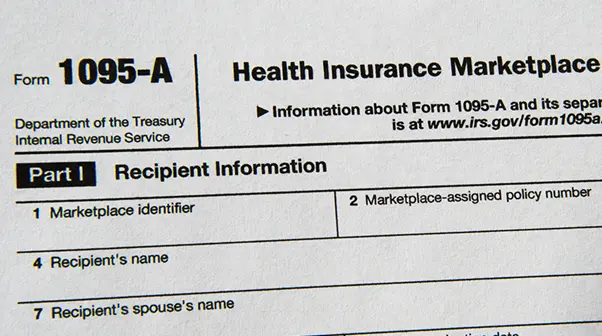

Form 1095-A: Health Insurance Marketplace Statement

Those who bought health insurance on the Health Insurance Marketplace get Form 1095-A. It gives the data required to finish the part of your tax return dedicated to the premium tax credit.

Who files it? The Health Insurance Marketplace sends this form to those who bought health insurance through it.

Purpose: To document acquired coverage as well as any premium tax credits, which must be reconciled on your tax return.

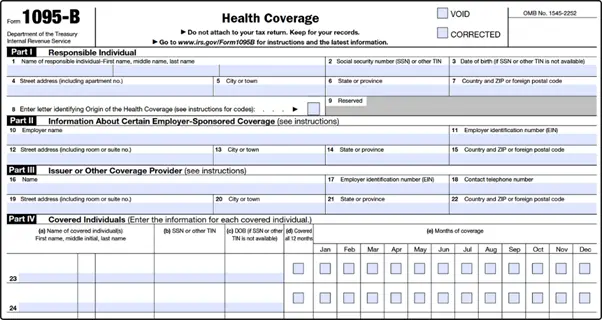

Form 1095-B: Health Coverage

Health insurance companies disclose information about those with minimum essential health coverage using Form 1095-B. This form indicates whether you, your spouse, and your dependents have qualifying health coverage all year long. Qualifying coverage is necessary to avoid the Affordable Care Act’s individual shared responsibility payment.

Who issues it? Health insurance firms, government programs (like Medicaid), or small businesses with self-insured policies all issue it.

Purpose: Reporting months of coverage will help you to satisfy the health insurance mandate.

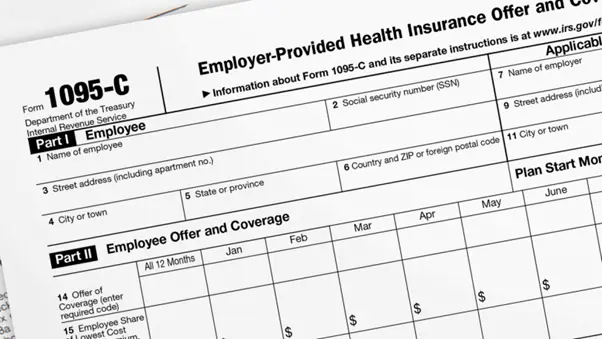

Form 1095-C: Employer-Provided Health Insurance Offer and Coverage

Large companies with 50 or more full-time workers use Form 1095-C to document whether they provide health insurance to their staff. It tells the kind of coverage offered, the employee’s premium contribution, and whether the plan satisfied minimum coverage requirements.

Who issues it? Companies have 50 or more full-time staff members.

Objective: To document the coverage offer made by the company, therefore enabling the IRS to enforce the Affordable Care Act’s employer mandate.

Form 1098: Mortgage Interest Statement

The lender’s mortgage interest paid is reported on Form 1098. By January 31st of every year, lenders must send a copy to the borrower together with a 1098 form they file with the IRS. The form needs the following material:

- Lender’s taxpayer identification number, name, and address.

- Name, address, taxpayer identity number of borrower.

- The mortgage interest payment amount.

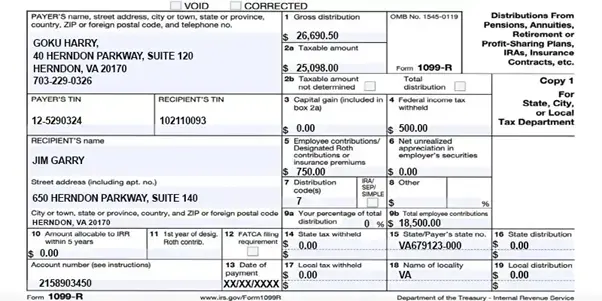

Form 1099-R: Distributions From Pensions, Annuities, Retirement or Profit-Sharing Plans, IRAs, Insurance Contracts, and others

Form 1099-R documents withdrawals from 401(k)s or IRAs, two types of retirement savings. The form indicates the distribution amount that is taxable and any amounts withheld for taxes.

Who files it? Retirement program administrators send this form to those who received distributions during a given year.

Purpose: The purpose of this is to report retirement disbursements, which, depending on the type of account and the age of the person, may be taxable as income.

Form 2441: Child and Dependent Care Expenses

Parents with jobs may apply for Form 2441 to file for the Child and Dependency Care Credit, which lets them cover some of their child care expenses.

Who files it? Taxpayers who paid for dependent or child care so they could either work or search for employment.

Purpose: To assert a tax credit for costs paid for a dependent or eligible child’s care.

Form 6251: Alternative Minimum Tax (AMT)

The Alternative Minimum Tax (AMT), a separate tax computation intended to guarantee that people and businesses pay a minimal amount of tax, is determined for this purpose.

- Who has to file: AMT-liable taxpayers are required to file a 6251 form.

- Necessary information: Income, credits, and deductions for the taxpayer.

Form 4868: Application for Automatic Extension of Time to File

Form 4868 allows you to seek an automatic six-month extension if you need additional time to file your federal income tax return. This does not, however, stretch the period to pay any taxes due.

Who files it: Form 4868 can be filed by any taxpayer needing more time to submit their return.

Purpose: Applying for a file extension gives you until October 15 to send in your return. Still, you have to project and pay any taxes due by the standard deadline, usually April 15.

Form 8829: Expenses for Business Use of Your Home

Form 8829 lets self-employed people deduct connected expenses from part of their house used for business. It enables you to figure out and assert the home office deduction.

Who files it? Self-employed people qualified for the home office deduction for running a business from their house.

Purpose: Document home office costs, utilities, and rent that might be deducted from your company income.

Form 8889: Health Savings Accounts (HSA) Contributions

Form 8889 is used to record contributions to your Health Savings Account (HSA), distributions taken, and whether those distributions were spent for qualified medical costs should you have an HSA.

Who files it? Taxpayers who contributed to or used money from an HSA during the year.

Objective: Report contributions and distributions connected to your HSA; determine whether you owe taxes on any payouts not spent for qualified medical costs.

Form 8962: Premium Tax Credit

The goal is to submit requests for the Premium Tax Credit, a refundable credit offered to anyone who buys health insurance through the marketplace created by the Affordable Care Act (ACA).

- Who must submit a file: In order to receive the Premium Tax Credit, taxpayers need to submit Form 8962.

- The necessary information: The taxpayer’s family size, income, and health insurance costs.

Importance of Understanding Tax Forms

Accurate tax filing and avoidance of any fines depend on knowledge of the several tax forms applied in the United States. Knowing the most often used tax forms helps you to make sure you are utilizing all the credits and deductions at hand. Furthermore, knowing tax forms will enable you to:

- Reliably document your income and deductions.

- Claim the right credit and deduction amount.

- Avoid being clear of possible fines and penalties.

- Use possibilities for tax savings.

Conclusion

In essence, filing taxes correctly and avoiding any fines depend on an awareness of the several tax forms applied in the United States. Knowing the most often used tax forms will enable both individuals and companies to negotiate the tax filing procedure with assurance. To be sure that you’re satisfying your tax responsibilities, always check the IRS website or a tax professional.